Tampa Bay Solar and Roofing Company

We install Roofing and Solar with Battery Backup

ABOUT US

Fused Solar and Roofing

Fused Solar and Roofing is Hillsborough County’s trusted choice for new solar installations, solar panel removal, reinstallation, repair, and EV charger installations.

As a fully licensed roofing and electrical contractor, we provide seamless, warranty-safe solar solutions for homeowners and roofing companies across Tampa, Brandon, Riverview, and surrounding areas.

Experience

With over a decade of hands-on experience, we specialize in new solar panel installations designed for long-term performance and energy savings. Our expert team uses high-efficiency panels and advanced mounting systems like K2 to ensure a leak-free, secure fit—whether for a new roof or a full energy upgrade.

Our mission is simple

Protect your roof, power your home, and make the process hassle-free.

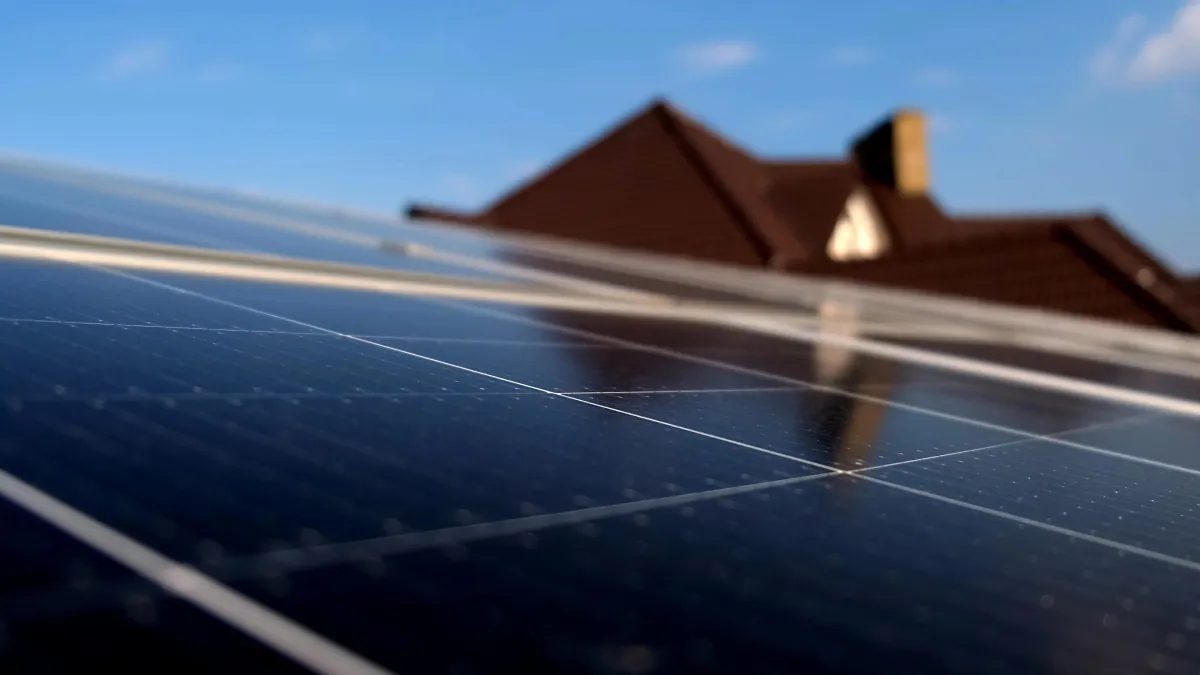

Solar Energy

Harness the power of the Florida sun to lower your electric bills and boost your home’s value.

Battery

Store extra solar energy for use at night or during power outages with reliable battery backup systems.

Savings & Quotes

See how much you can save—get your personalized solar quote today at no cost.

Complete Solar Installations

Power your home with clean, reliable energy.

We install high-performance solar systems tailored for Florida homes. Save on electricity, boost property value, and take control of your energy future.

Solar Removal & Reinstall

Need roof repairs with solar panels installed? Fused Solar’s certified team safely removes, stores, and reinstalls your system, protecting your investment every step of the way.

EV Chargers & Battery Backups

Future-proof your home’s energy.

Install EV chargers and battery systems like Tesla Powerwall or Enphase. Seamless integration, fast setup, and financing options available.

Our Solar Installation Process

Hillsborough County, FL

At Fused Solar and Roofing, we make it easy for homeowners and businesses across Tampa, Brandon, Riverview, and surrounding Hillsborough County to switch to clean, renewable energy. Here’s how our streamlined solar installation process works:

Remote Solar Assessment

We use satellite imagery and solar design software to evaluate your roof’s sun exposure, size, and shading. This allows us to design a high-efficiency solar panel system without an on-site visit.

Custom System Design

Your system is tailored to your home’s energy needs, roof layout, and budget using premium equipment and Florida-compliant designs.

Permits & Utility Approvals

We handle all permitting and utility paperwork with Hillsborough County and your power company to keep the process stress-free.

Solar Installation

Our licensed Tampa-based solar installers complete your installation in 1–3 days using roof-safe mounting systems that protect your warranty.

System Activation

Once final inspections are approved, we activate your solar system—so you can start saving on energy immediately.

Local Support

We’re based right here in Hillsborough County, providing reliable post-install support and long-term system care.

Solar Panel Removal & Reinstallation — Guaranteed Leak-Free

Need to replace your roof but already have solar panels?

At Fused Solar and Roofing, we are GAF-approved contractors specializing in solar panel removal or reinstallation services

designed for homeowners upgrading replacing their roofs.

Whether you’re planning a full roof replacement or simply need to move your system, we provide safe, professional solar panel removal, battery storage, and expert solar panel reinstallation — all backed by our 25-year no-leak roof guarantee where the panels meet the roof.

What Our Customers Are Saying